According to a report published by Gallup last summer, only 34% of employees in the US are actively “engaged” with their jobs. This is an improvement from figures recorded earlier, but it still means that about two-thirds of employees are disengaged.

These are worrisome statistics all businesses should seriously consider. After all, between absenteeism, employee churn and contagious lackluster motivation levels, disengaged employees are estimated to cost companies in America between $450 and $550 billion per year.

Start with a Well Thought Out Plan

If businesses leaders are serious about increasing their revenues, they’re going to need a well-planned-out approach to curbing employee disengagement.

All too often, when businesses realize that employee engagement is low, the blame is pointed back at the employees themselves, and nothing is done about it. This is a huge mistake — leaders need to know better and take more responsibility than that.

So, if employee engagement is down at your organization, it is time for the leadership to do their bit in boosting it by correcting previous mistakes that caused it.

Reasons for Employee Disengagement

Here are the usual culprits from leaders that lead to employee disengagement.

1. Neglecting Proper Communication With Employees

According to data from the International Association of Business Communicators, poor communication skills among managers is the top barrier to improved information flow in organizations. If your employees find that their leaders don’t recognize their achievements, don’t provide clear directions, don’t care about their lives outside of work and have no idea how to offer constructive criticism, then why should they aim to deliver their best work?

The most important thing to do is to regularly thank and congratulate employees for their efforts. Make sure you do this both for individual employees and for the team as a whole.

Also spend ample amount of time having real, meaningful conversations with your employees. Ask them about their lives outside of their work and if everything’s alright. This will make a huge difference.

Make sure that plenty of additional channels of communication are open and available. Face-to-face talks might be the best, but some of your employees would likely prefer communicating through an online channel.

When managers are more open and approachable, it has a positive effect on employee engagement.

Someone who understands the importance of building a culture and properly communicating with his employees is Zappos CEO Tony Hsieh. He communicates with them through personalized email updates, all-hands meetings and informal team gatherings. Here’s a comment (recommendation) an employee left on Tony’s Linkedin page.

This level of dedication towards his employees has helped Tony build an engaged workforce that generates over $2 billion annually and was acquired for $1.2 billion. Leaders and managers at companies of all sizes must make a note of this.

2. Having an Inferior Personal Brand

Many leaders make the mistake of believing that the only thing that contributes to effective leadership is their activity at work. But it’s also super important to realize that their online presence matters too. The average person spends 5.9 hours per day online. A lot of this time is spent using social networks. They do this even while at work.

It is very likely that your employees are following you and are reading your updates. This is why the manner in which you conduct yourself on the internet has such a huge influence on how much your employees respect you. If you develop a personal brand as a leader in your industry, your employees will look up to you and the company you contribute to.

So pay close attention to the brand image you project on your social media channels. And build your presence on more professional social networks like Twitter, Medium, Linkedin and AngelList. Expressing thought leadership through blogging or a holistic content marketing strategy can help too.

An example of a leader who understands the importance of building a presence through thought leadership online is Dharmesh Shah. Many people already know that he is a founder of HubSpot, and he’s projected his tech and marketing expertise through articles like these on the HubSpot blog.

Projecting Your Personal Brand

Shah has also projected his expertise as a founder who cares about creating companies with engaged employees and a good culture through his OnStartups blog. He regularly speaks at conferences and has authored a number of well-received books. Shah also adds to his personal brand by explaining his areas of expertise on his Linkedin account, which is something every business leader can do, regardless of company size and level of influence.

This type of activity can help keep your current workforce engaged, while also helping your company easily attract more engaged employees.

Another way to easily display your personal brand and expertise online is by using a site like Crunchbase, an authoritative directory of leaders and companies that are active in startup ecosystems. Here you can list things like the social networks you are active on, the recent press coverage you have received and more. Your employees and potential employees are likely active on Crunchbase.

For example, let’s take a look at Russ Ruffino’s Crunchbase profile. Ruffino doesn’t have anywhere near the name recognition that Dharmesh Shah has, but by maintaining an active profile, he makes a strong impression.

Getting a High CB Rank

Here people can see that he has a relatively high “CB Rank” on the site, in the top percentile. They can see that he is the founder of the company Clients on Demand, which also has a good rank on Crunchbase. On his profile, you will find links to his website where you can access his articles, podcasts, videos and interviews. There are also links to social networks like Facebook, Linkedin and Twitter. When people view his website and social networks, it strengthens his brand identity.

If you scroll down further on his Crunchbase page, you can see the recent publications that Ruffino has been featured on. This includes top sites like Entrepreneur and International Business Times.

All this content shows people that he is a leader in the client acquisition niche. A vibrant, dynamically updated digital footprint like this can go a long way towards improving team engagement, as his current employees will feel proud to work for him.

3. Failing to Actively Develop Leaders

Some 46% of employees feel that their own leadership skills aren’t being developed. This is a huge mistake, as businesses need to take steps to spot and develop new leaders within the company. If employees show leadership potential, it is the job of current managers in the company to mentor them and improve their skillsets.

When you groom leaders from within your company, it makes the job of the managers easier, as it helps to give people a greater sense of investment in the company. It will also help you keep some of your best talent around for longer, as 67% of employees say they would leave a position if it lacks avenues for leadership development.

So, get your managers to keep an eye out for the natural leaders present within your company. It’s a lot cheaper, easier and less risky to hone top leaders within your company and promote them as managers than to hire strangers from outside.

Here are a few things you can do to develop online leaders.

1. Conduct tests. Before you begin developing leaders, it is important to figure out who shows the strongest potential. So make sure all your new employees complete assessments.

2. Offer training. Purchase courses, webinars and conduct workshops on leadership that will help these employees develop their leadership skills further.

3. Turn current leaders into mentors. Get your leaders on board with mentoring these employees by sharing their own tips and experience on the subject.

Taking these three steps will ensure you build leaders for the future.

Conclusion

These are three common mistakes leaders make that result in employee disengagement. Address them, and you will likely notice a boost in morale, collaboration and even revenue.

Image: Depositphotos.com

This article, "Making These 3 Mistakes Can Cause Employee Disengagement in Your Business" was first published on Small Business Trends

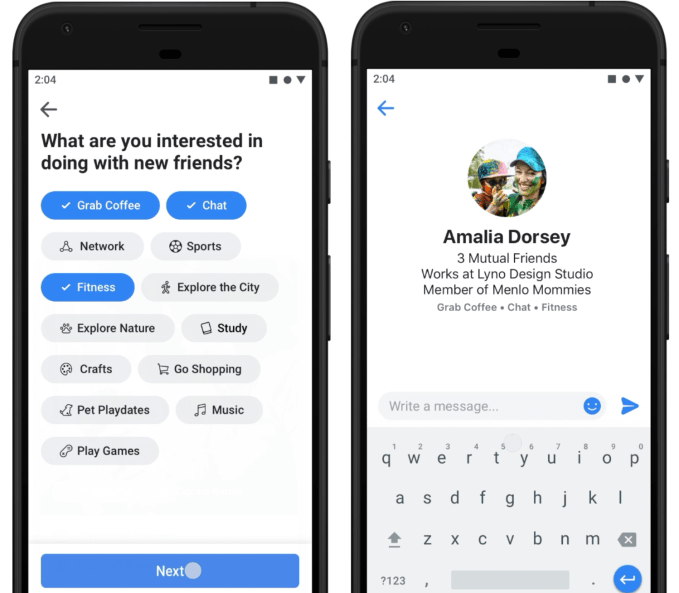

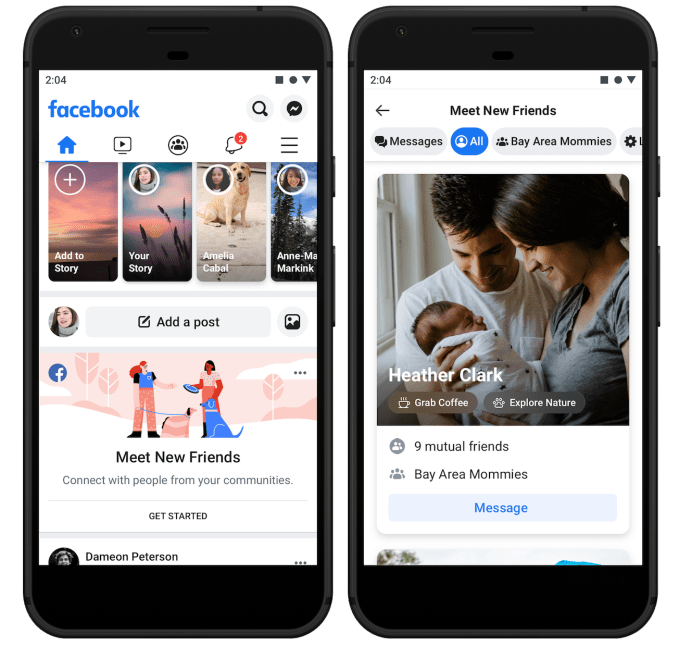

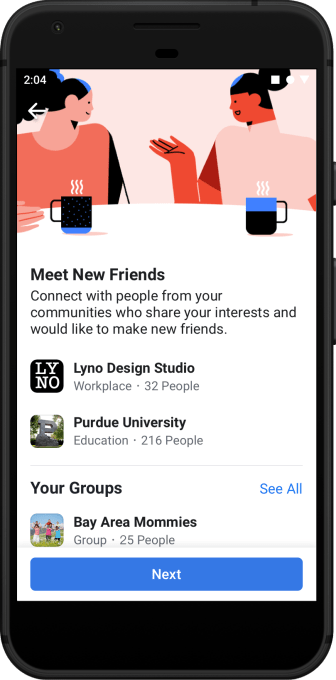

Fidji Simo, the head of Facebook’s main app, tells me Meet New Friends was based on emerging behaviors the company had spotted. “Developing relationships with people they didn’t already know is very different from the core use case of Facebook,” but she notes, “We’ve already seen that naturally happen in Groups, and Meet New Friends will make that a bit easier.”

Fidji Simo, the head of Facebook’s main app, tells me Meet New Friends was based on emerging behaviors the company had spotted. “Developing relationships with people they didn’t already know is very different from the core use case of Facebook,” but she notes, “We’ve already seen that naturally happen in Groups, and Meet New Friends will make that a bit easier.”