[[ This is a content summary only. Visit my website for full links, other content, and more! ]]

Monday, 31 December 2018

6 Tips for Investing in Life Sciences

[[ This is a content summary only. Visit my website for full links, other content, and more! ]]

NYSE operator’s crypto project Bakkt brings in $182M

The Intercontinental Exchange’s (ICE) cryptocurrency project Bakkt celebrated New Year’s Eve with the announcement of a $182.5 million equity round from a slew of notable institutional investors. ICE, the operator of several global exchanges, including the New York Stock Exchange, established Bakkt to build a trading platform that enables consumers and institutions to buy, sell, store and spend digital assets.

This is Bakkt’s first institutional funding round; it was not a token sale. Participating in the round are Horizons Ventures, Microsoft’s venture capital arm (M12), Pantera Capital, Naspers’ fintech arm (PayU), Protocol Ventures, Boston Consulting Group, CMT Digital, Eagle Seven, Galaxy Digital, Goldfinch Partners and more.

Bakkt is currently seeking regulatory approval to launch a one-day physically delivered Bitcoin futures contract along with physical warehousing. The startup initially planned for a November 2018 launch, but confirmed this morning an earlier CoinDesk report that it was delaying the launch to “early 2019” as it awaits permission from the Commodity Futures Trading Commission. Along with the funding, crypto news blog The Block Crypto also reports Bakkt has hired Balaji Devarasetty, a former vice president at Vantiv, as its head technology.

ICE’s crypto project was first announced in August and is led by chief executive officer Kelly Loeffler, ICE’s long-time chief communications and marketing officer. Bakkt quickly inked partnerships with Microsoft, which provides cloud infrastructure to the service, and Starbucks, to develop “practical, trusted and regulated applications for consumers to convert their digital assets into U.S. dollars for use at Starbucks,” Starbucks vice president of payments Maria Smith said in a statement at the time.

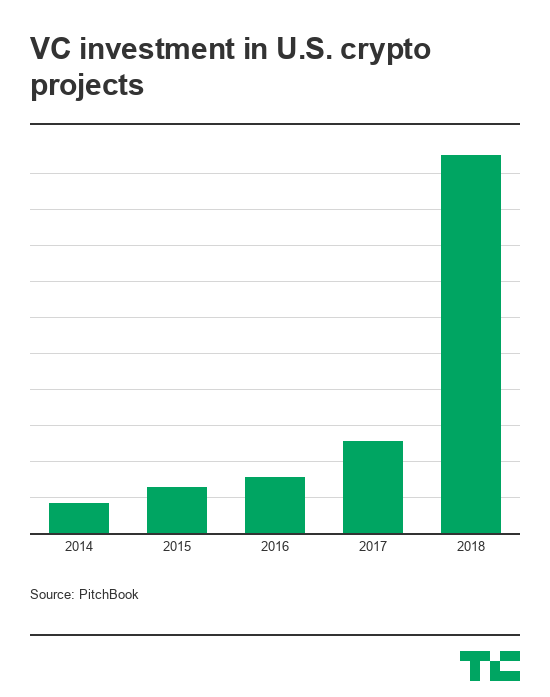

Many Bitcoin startups floundered in 2018, despite record amounts of venture capital invested in the industry. This was as a result of failed initial coin offerings, an inability to scale following periods of rapid growth and the falling price of Bitcoin. Still, VCs remained bullish on Bitcoin and blockchain technology in 2018, funneling a total of $2.2 billion in U.S.-based crypto projects — a nearly 4x increase year-over-year. Around the globe, investment hit a high of $4.6 billion — a more than 4x increase from last year, according to PitchBook.

“Notably, 2018 was the most active year for crypto in its brief ten-year history,” Loeffler wrote. “This was evidenced by rising investment in distributed ledger technology and digital assets, as well as by blockchain network metrics such as daily bitcoin transaction value and active addresses. Yet, these milestones tend to be overshadowed by the more narrow focus on bitcoin’s price, which has been seen by some, as a proxy for the potential of the technology.”

Today, the price of Bitcoin is hovering around $3,700 one year after a historic run valued the cryptocurrency at roughly $20,000. The crash caused many to dismiss Bitcoin and its underlying technology, while others remained committed to the tech and its potential for complete financial disruption. A project like Bakkt, created in-house at a respected financial institution with support from noteworthy businesses, is a logical bet for crypto and traditional private investors alike.

“The path to developing new markets is rarely linear: progress tends to modulate between innovation, dismissal, reinvention, and, finally, acceptance,” Loeffler added. “Each step, whether part of discovery or adversity, ultimately strengthens the product. Twenty years ago, it was controversial to suggest that commodities or bonds could trade electronically on a screen, and many steps were required for that evolution to play out.”

Year in Review: A Look Back at Small Business Trends in 2018

Here at Small Business Trends we’ve had an amazing year and we could not have done it without you. We’d like to share a look back, with our 2018 Annual Report.

The Year Started Slow – But Ended Great!

The year 2018 has been fantastic overall for us. But the year did not start out that way.

Sales in the first quarter of 2018 were slow. At the end of February cash flow was at a low point.

But the team did not let that get us down. Instead, it inspired us to work harder. We spent the next two quarters catching up, getting out of the red and back to the black.

And then we had a terrific fourth quarter to cap things off. More on that in just a bit.

Thank you, dear readers, from the bottom of our hearts. You inspire us to do better.

And thank you to our valued sponsors and advertisers. You provide the financial backing to keep Small Business Trends publishing. We appreciate your business!

In the following annual report I will go over our accomplishments, the challenges we faced, and why we are so stoked for 2019!

Accomplishments by Team Small Business Trends

Reached 30% More Small Business Owners

Our traffic grew considerably during 2018. We were able to serve 30% more small business owners this year compared to last.

We are in the digital publishing business. Think of our business as similar to a magazine or newspaper. Just as with any magazine or newspaper, our “circulation” numbers are a key performance indicator.

Some of you found us via Google and other search engines.

With the boost in search traffic we also got a pull-through in direct traffic. We’re telling our story better, and that has improved our brand recognition. For example, we improved our About Small Business Trends page.

While traffic is good, that doesn’t mean anything unless we meet your expectations. Using advanced analytics and big data, we were thrilled to discover:

- A core group of readers are brand lovers of Small Business Trends. Over 11,000 of you visit an average of 35 times a month. Wow!

- Another 300,000 visit many times a month.

- And another 1,750,000 visit a bit less frequently during the month – typically one to a few visits.

Our goal is to give you more content you desire, so that you WANT to return — often. For that, we knew we had to better understand what you like and what engages you. That’s why data is so important to a small business.

Our big data analytics revealed other useful insights. For example, we learned that longer content is more popular. Content with at least 1,000 words has longer time on page and better engagement overall.

Here’s another interesting factoid. Not only do YOU prefer longer content, it’s also better for us. Longer content earns more — at least 5X more. See Revenue by Word Count chart below.

Conclusion: Be data driven. Don’t assume anything about your audience or customers. Each business, site and audience is unique.

Reinvigorated Our Social Media

We got a small but sustained boost in traffic from revising how we approach social media.

Over the past decade, we’ve gotten considerable traffic and branding visibility through social media. After all, we’ve been on Twitter since 2007 — that’s 11 years!

But times have changed. So we had to change:

- We rebranded our @smallbiztrends Twitter account from a combined personal/organizational account to a company account. I started using my individual account (@anitacampbell).

- Our social media manager has increased engagement 150% through several strategies, including sharing humorous content.

- We improved our LinkedIn presence, publishing more content there.

- We upped our presence on Pinterest, YouTube and Quora. And we cut back on Google+, in light of Google’s plan to shutter the network in 2019.

Conclusion: Social media is evolving. Every small business should periodically re-examine what it is doing and where.

Achieved 25% Improvement in Production Processes

We refined our internal content production processes, achieving 25% improvement.

In the publishing business, content is our product (not just a marketing technique). Efficiency, quality and quantity all matter. Processes and systems can make or break profitability.

- Our executive editor did a fabulous job guiding the team toward evergreen content that leverages our content investment wisely.

- Our assistant editor did a magnificent job coming in 10% under budget for content expenses. He manages a global team of talented writers.

- Our search specialist does wonders on on-page optimization.

- Our editorial assistant does a great job filtering news to keep our publishing schedule moving.

- Our client administrator worked with the Content team to ensure 96% on-time delivery of sponsored content deliverables.

The team collaborates virtually. We are proud of being able to operate as if we are in the same room — even though we are across the globe. We use various chat tools and shared documents to achieve this.

Occasionally we even hold our Tuesday executive team meetings by video. Note the screen capture image at the top of this report showing a recent meeting.

We estimate we got 25% process improvement overall.

Conclusion: Process improvement opportunities in a small business are often small things staring you in the face. Improving one small thing may not move the needle. But add up several changes and the difference becomes meaningful.

Challenges We Overcame

Like any small business, we face challenges every day. In 2018, team Small Business Trends had three large challenges to overcome.

Compensated for Seasonality

As I mentioned at the start of this piece, our first quarter of 2018 started in the red. Why? Seasonality.

Revenues in our industry are seasonal, just like many of your businesses. Our business model is based primarily on ad earnings. We are able to provide content free to you because we earn from advertisers and sponsors.

Advertiser spending is traditionally lower in the first quarter. And for unexpected reasons, we ended the prior year with smaller-than-normal cash reserves.

I was honest with the executive team. I explained what we were facing. There’s no point in hiding the situation. If you do, you can’t get your team’s help to turn things around.

I’m happy to report that team Small Business Trends rose to the challenge. We not only managed to get through the first quarter, but we had an amazing turnaround in eight months. Two factors contributed.

First, we forged a strong partnership with the right ad revenue partner. This gave us a recurring revenue stream. We have multiple revenue streams, but most have huge swings from month to month. Having one revenue stream that’s more predictable made all the difference.

Second, ad rates for the final three quarters of 2018 were on fire. The Ad Revenue Index image above below rates for the entire industry during 2018. Rates nearly doubled between January and December, as you can see from the image below. That helped too.

Conclusion: Find at least one predictable revenue stream. It alleviates some of the white knuckle pressure to meet payroll. You will be freed up to work ON your business, not just IN your business.

Addressed Deferred Maintenance

Imagine for a moment that you were so busy, you didn’t have time to keep your store shelves and warehouse organized. You didn’t have time to clean the premises.

Fifteen years go by. Just think what your business would look like!

That’s what we were facing. Think of this website (smallbiztrends.com) as our storefront and warehouse.

For 15 years we kept creating new content. As the site grew, maintenance required more time — so we tended to put some of it off. As a result:

- Outdated content piled up like virtual dust bunnies.

- Older links broke.

- Technical issues negatively affected Google crawling.

To top it off, we came face to face with the 80/20 rule. Big data analytics showed that 80% of our ad revenue is driven by about 20% of our content.

This is caused by two factors. First, some older content is simply outdated. Second, the more content you have, the deeper the best content gets buried.

We knew we had to take a step back in order to grow in 2019.

We started by conducting a site audit using a tool called SEMRush. The great thing is that the tool gives a roadmap for how to fix the issues, and we’ve made good progress already.

Conclusion: Don’t put off maintenance. Time is not your friend.

Optimized Site Speed

Site speed is more important than ever, especially with the shift toward mobile visitors. So we set a goal to improve site speed during 2018. And I am happy to report the site is much faster today than before we started.

One of the changes that dramatically improved site speed for us was caching pages on a CDN. Previously it would take a few extra seconds or partial seconds to create the page dynamically. Caching really helped.

But improving speed is not a “once and done” task. Many factors slow a site down. In fact, speed varies page by page. And new issues pop up. We have to continually tweak.

Conclusion: With some challenges the bar is always moving. Keep at it.

Looking Ahead

So there you have our 2018 Annual Report from Small Business Trends. We accomplished some things we are proud of. And we managed to overcome some gnarly problems.

For 2019 we intend to:

- Understand voice search. Voice search is the next frontier. I bought voice search devices for each of the executive team members, so we can experiment

- Organize the site more. We will continue weeding out older, less relevant content. We will focus more on structure.

- Improve user experience. We intend to focus on improving the mobile experience for you, in particular. We’ve already started. For example, we recently widened our mobile template by a number of pixels. When we implemented our responsive template five years ago, mobile screens were narrower. Screens have trended larger since then. In addition, our COO has undertaken UX improvement as a special project of hers.

- Focus on branding. We will strive to increase brand recognition. Knowing we have so many loyal readers encourages us to do more to stay top of mind.

- Continue building team strength. One thing we’ve learned over 15 years is that a small business’s strength is its team. When our team members put our collective heads down, we accomplish amazing things So we are investing in training and expanding the knowledge of the team.

We can’t wait to see what 2019 brings!

We at team Small Business Trends hope this Annual Report inspires you to reflect back on YOUR success. After all, that’s our mission. “Small business success … delivered daily” means we strive to help you be successful, everyday.

Wishing you a successful year,

Anita Campbell, Founder and CEO of Small Business Trends.

PS: What are you proudest of from 2018? What do you plan to focus on in 2019?

This article, "Year in Review: A Look Back at Small Business Trends in 2018" was first published on Small Business Trends

Year End Report Looks at Email Marketing on the Biggest Shopping Days of 2018

The one marketing channel which has been delivering consistently for years is email. And with a record-breaking $7.9 billion in sales for Cyber Monday 2018, SendGrid wanted to know just how marketers were using email.

SendGrid analyzed the data from the record 2.9 billion emails sent on Cyber Monday alone. The company surpassed its highest sending volume to date and looking at this data the company found valuable insights marketers can use as part of their sending strategy.

For small businesses, this report highlights the benefits of using email as part of a comprehensive digital marketing strategy. Because according to SendGrid, email is the number one digital driver of ROI for brands responsible for 24.2% of traffic.

However, email is not being used as effectively by small businesses. In an email interview, Small Business Trends asked SendGrid’s Len Shneyder, Vice President of Industry Relations:

Why are more small businesses not taking advantage of email marketing considering it consistently delivers when it comes to conversions?

Shneyder said, “Email at scale is challenging, therefore, it might seem daunting to small business owners or they might think they lack the tools to utilize email as a growth channel. But that need not be the case. Email marketing is extremely cost-effective. It remains the best digital marketing channel for return on investment and email’s cost-per-acquisition is the lowest of all media types, according to the Data & Marketing Association. Our research also found that nearly 50% of consumers have purchased from websites after seeing a marketing email.”

Shneyder goes on to say while some businesses use email, they’re not taking full advantage of the full spectrum of tools available to them. He says small businesses can use, “A broad range of email applications from a simple newsletter, to an automated onboarding series, to similar product recommendations, promotions/sales and transactional emails like email receipts and password resets.”

2018 Holiday Email Marketing Trends

One of the data points most often cited is the time you send an email. However, SendGrid reports the time you send the email doesn’t affect open rates for most of the day.

It goes on to say when you send an email during the evening time it raises opening times to almost 8 hours. Therefore, the company recommends sending time-sensitive deals before evening time to make sure they’re well received.

What about Black Friday and Cyber Monday?

Regarding Black Friday, the open rates for emails on this day were 42 minutes faster than regular Fridays, which stands at around 4.5 hours.

Ironically enough, using subject lines which use “Black Friday” and “Cyber Monday” were performing worse than those which didn’t mention the events.

SendGrid recommends marketers to use subject line switch leverage segment specific interests, previous purchase behavior, or provide an innovative, clever, and compelling value proposition to entice the consumer.

Additional data points during Black Friday and Cyber Monday are: fewer exclamation points were used, even though this practice was higher in 2018; usage of discounts in subject lines fell to only 6%, and 26% will click more than once on links in the same email during Black Friday/Cyber Monday.

So, Small Business Trends asked Shneyder:

Why should email be part of the overall digital marketing strategy for small businesses?

“Besides being the most cost-effective channel in terms of ROI with $38 of return for every $1 of investment (DMA), email is consumers’ online identifier to sign up for new products and services and retrieve important user credentials. People change their home address more frequently than their email address, therefore, email serves as the system of record for our digital lives.”

He added, “Given the proliferation of email vs. the world’s population, it’s only natural that every new business will turn to email to create connective tissue with customers and prospects. In fact, we found that 67% of consumers believe email is essential to their lives and Gen Z expects to increase or maintain their email usage over the next 5 years.”

Whether it is Black Friday/Cyber Monday or any other day of the year, email is a cost-effective marketing solution for small businesses. This is especially true for startups with limited budgets.

As Shneyder said, “It’s important for small business owners that are not using it to understand that email will be the most effective means of reaching their audience out the gate and as they grow.”

Photo via Shutterstock

This article, "Year End Report Looks at Email Marketing on the Biggest Shopping Days of 2018" was first published on Small Business Trends

Square Appointments Allows Businesses to Reach Customers on Instagram and Google

As a payment solution, Square (NYSE: SQ) is always looking to improve its platform by bringing the physical and digital world together for a seamless ecosystem.

The company’s latest endeavor in this area is the integration of Instagram and Google with Square Appointments. This will allow users to reach more customers in two of the most popular digital platforms.

Square Appointments on Instagram and Google

For small businesses with a digital presence, this integration will make it possible to acquire new customers from their social media feed on Instagram or search results in Google. And if you don’t happen to have a website, Square Appointments still allows you to get discovered on Instagram and Google.

How Does it Work?

If you are a business with an Instagram account, you can add a call-to-action (CTA) button to your page. When a customer clicks on the CTA button, they will be able to instantly book an appointment through Square Appointments.

All this takes place without leaving the Instagram app, which adds to the user experience.

For Google, you have to opt-in to Reserve with Google. When a local customer searches for the services you provide it will allow them to create, cancel, and reschedule appointments directly from their Google Search and Maps.

This also takes place within the app, which removes another friction point for consumers when it comes making an appointment. When the appointment is finalized, the business will be notified of any new booking through Reserve with Google.

What is Square Appointments?

Square Appointments makes all of your services bookable by customers on your online booking website, through booking links and now on Instagram and Google.

The intelligent scheduling of Appointments syncs your personal calendar to ensure your availability is always accurate through a cloud-based platform.

With the cloud, you can access the appointment anytime and anywhere so you can keep track of all your bookings. And because Appointment allows the customers to reschedule, you will also be able to see any of the changes as they happen.

If you have a team of workers, each employee can see their individual calendar and see their schedule on any synced device. When they get an appointment, they will receive confirmation directly.

As an administrator, you can give employees different levels of access, adjust schedules, manage every location from a single account, and track all the schedules to see who is available.

With this solution in place, you will be able to attend to your customers’ needs with a personal touch. The platform gives you the appointment history, personal details, notes, and purchase history of each customer. This information lets you provide customized service for all of your clients.

You can also send friendly reminders to your customers or inform them about any changes which might take place.

According to Square, this integration has resulted in businesses experiencing an average of 34% year-over-year increase in reservations with Square Appointments.

Point of Sale Integration

It goes without saying Square has also built its point of sales feature right in with Appointments.

Customers can pay for items and services directly from an appointment, with sales automatically being attributed to the right employee. At the same time, you can track your stock in real time and get email alerts when items run low.

When a customer is ready to pay, the Square payment ecosystem accepts every kind of payment quickly and delivers your funds almost instantly.

Image: Square Appointments

This article, "Square Appointments Allows Businesses to Reach Customers on Instagram and Google" was first published on Small Business Trends

The A to Z of Financing Your Own Business

You have an idea for an exciting new business. You’ve done your research and you’ve written a business plan. Now it’s time to answer the big question – how to finance a business. Let’s take a look at your options and the things you’ll need to consider in your quest for business funding.

Small Business Funding

Business funding is a broad concept. It can be used to describe many the financing needed for various business situations, like starting a new company, expanding a current business, or covering cash gaps. For now, we’ll focus on business funding as it relates to financing a brand-new business.

Things to Consider When You Finance a Business

Before you dive head first into your financing options, take some time to really understand what you’re financing. This is imperative. Obviously, you need to know how much funding is required to get your business off the ground. We’ll get into that a bit later. But you also need to have an idea of how those funds will be allocated.

Whether you’re borrowing money from a bank, working with a group of investors, or getting a loan from your parents, you’ll need to be able to explain what the money will be used for in specific terms. Here are some aspects of your business that could require startup capital.

Renting or Buying Space

If your business will be headquartered in your garage or a spare bedroom, great. You probably won’t need to worry about money for a workspace. But look into the near future – if your business grows the way you intend, can you sustain it in your garage?

For those who need a space, like an office, warehouse, or workshop, check out your options for renting or buying and keep those figures in mind for your overall financing needs.

Hiring Staff

Unless you’re running a one man show, you’ll need employees. And unless you have a network of people lined up to work for you, you’ll have to post jobs, work with recruiters, and run background checks – all of which cost money. Many people don’t realize, there are costs associated with hiring employees, not just paying their salaries. If you’re in the market for executives, senior management, or high-level tech gurus, your costs will be even higher.

Inventory

Depending on your business model, you may require inventory to get started. Since you can’t make money without first having inventory, these costs will be part of your business financing.

Equipment

Whether it’s a simple laptop or a multi-million-dollar piece of machinery, the costs for your equipment will likely come from your startup funds. Keep a running list of all the equipment you’ll need, not just the big stuff.

Managing the Customer Journey

Not so long ago, customer service was just something that happened when a consumer called your company. Nowadays, customer experience is a huge part of the success (or failure) of any business. When you’re figuring your startup expenses, don’t forget to include the cost for consultants or third-party tools like surveys to manage your customer’s journey.

Working Capital and Day-to-Day

Remember those employees you hired? Well, they’ll be expecting a paycheck, whether your business is turning a profit or not. Consider how much financing you’ll need to sustain your employees’ salaries and benefits.

And don’t forget the day-to-day costs of running a business. Incidentals come up all the time and it’s important you have an operating fund to keep you covered.

How Much Funding Do You Need?

Now that you have a nice list of the specific costs associated with starting your business, it’s time to figure out how much money you’ll really need.

Unfortunately, there’s no magic number or special formula that will help you decide how much financing your business needs. There are some guidelines you can follow, though. Start by estimating the amounts you think you need for each of your expenses. Then compare those estimates to the following criteria.

What’s the ROI?

Figure the approximate return on investment for the funding amount you estimated. If result is an unacceptable ROI, you might need to reconsider your amounts in some areas. And remember, certain expenses will be just that – expenses. Things like your daily operating budget won’t have a measurable ROI.

How Quickly Can You Pay Off the Debt?

Debt is a pretty common part of starting a business. But no one wants to be in debt forever. Think about how long it will take you to pay off the amount you’re thinking of financing. If the term is longer than you’re comfortable with, you might need to scale back on the funding in some areas.

Will You Incur More Debt Later?

Your initial answer is probably, “Of course not!” But don’t be so hasty. Incurring more debt isn’t always a bad thing – Like when your business explodes, and you need more inventory. Other times, you might fall a little short and need some help bridging the gap.

In any case, be conscious of the potential need for more financing in the future. Be honest about whether you could manage both debts and how you would do it.

Types of Business Funding Available

Business funding generally falls into three main categories — debt financing, equity financing, and bootstrapping.

There is no better or worse option. Each type of financing has its place in different business scenarios. The type of funding you choose will depend on your business model, your goals, and your resources. Here’s how each of them works.

Debt Financing

Debt financing means you’re borrowing money. The word debt might make you cringe, but not all debt is bad. Most businesses in the world have been in debt at some point, that’s how most of them got started.

Business loans from a bank and borrowing money from friends or family are both examples of debt financing. In these cases, the amount you borrow must be paid back (with interest if you’re working with a bank.)

When you fund your company with debt financing, you have the distinct advantage of maintaining complete control of your business.

Equity Financing

Equity financing means you sell part of your business to investors in exchange for funding. There’s no loan, interest, or repayment involved.

Angel investing is the phrase commonly used for startups. Angel investors give business owners money to start their companies and in exchange, the investor is given a portion of the business.

While there’s no repayment needed for equity financing, you are relinquishing part of your business to your investors. Some investors may be totally hands-off, trusting you to handle all the business. Other investors may wish to be involved in some of the decision making.

Bootstrapping

The word bootstrapping means using your current resources in a situation. The term can be applied to all sorts of scenarios. In the case of financing your business, bootstrapping means you rely on your own personal finances to get your business off the ground.

It’s an attractive thought, considering you won’t be in debt to anyone nor will you have to sell any shares in your company. And you’ll be in complete control of your business. It can be a hard road to travel though, especially if your personal resources are limited.

How to Decide on Financing

Every business is different, and so is every funding situation. The type of business financing you choose will depend on many different factors. And there’s no rule that says you can only use one type.

Many startup owners opt to take on a few investors, get a small loan, and invest some of their own money.

Here are a few of the things you should take into consideration when deciding on which financing option(s) to choose.

Consider How Much Capital You Need

If you only need a small sum to get your business off the ground, bootstrapping could be an option for you. Larger amounts may require loans, investors, or both.

Reflect on Your Own Finances

The idea of bootstrapping is enticing, but it’s not for everyone. If your personal finances can’t sustain running a business and taking care of your other responsibilities, you may need to investigate other financing opportunities.

Admit Your Tolerance for Risk

Bank loans must be repaid. If your company fails, no matter how sad the situation, the bank still wants its money. If this thought terrifies you, think long and hard about your approach to financing your business.

Think About Your Relationships

What happens if you’re unable to pay back your family and friends? Will this effect your relationships? Before accepting loans from people with whom you have close ties, be realistic about how it could play out.

Check Your Credit Score

Thinking about a loan? Your credit score will be a factor is financing through a bank.

Decide on Your Willingness to Work with Investors

If you choose to go with equity financing, you’ll be giving up part ownership in your company. This is a perfectly acceptable trade-off for some business owners while others may be totally against the idea. Before you enter into an agreement with investors, be sure you understand the short-term and long-term effects it may have on your business.

Other Considerations

Once you’ve settled on the amount needed to finance your business, you can begin approaching banks or investors for funding. Be careful during this process. You may be surprised when you’re offered more money than you actually planned for.

It will be tempting to accept a larger loan or a higher amount of investor funding. But doing so could be detrimental to the long-term health of your business. Taking out a big bank loan means a longer term of payments and more money paid toward interest. Signing on more investors than you need will result in losing more and more ownership in your company.

You worked long and hard on your business plan and you should give equal attention to your financing plans. Be honest and precise about the money you need and use the funding according to your plan.

Republished by permission. Original here

Image: Due.com

This article, "The A to Z of Financing Your Own Business" was first published on Small Business Trends

14 Most Profitable Products for Handmade Woodworking Businesses to Build and Sell

Making beautiful, hand-crafted wood items to sell is an extremely creative and rewarding way to make money. Naturally, like any art or craft project, some woodworking creations sell better than others.

Most Profitable Woodworking Projects to Build and Sell

If you’re determined to turn your creative, woodworking skills into profit, take a look at the following 14 most profitable woodworking projects to build and sell.

Wooden Toys

Unlike many of their plastic counterparts, wooden toys can withstand the test of time. Not only do they possess longevity, but toys made of wood look fabulous in nurseries and children’s bedrooms, hence these quirky items will always be sought-after.

Put your best woodworking hat on and start making wooden dolls, puppets, train sets and more – the perfect gift for a child at Christmas.

Coat Racks

Rustic coat racks made from wood make a striking feature on the wall of any home. These desirable home accessories are also easy to build requiring little more than some chunky wooden, nails and wrought iron hangers, making them a super profitable woodworking project.

Fruit Bowls

Fruit bowls are a ubiquitous feature in almost every household, providing an eye-catching and practical feature in kitchens and dining rooms. These household accessory staples look even more striking when made from real wood.

Whether they’re made from a solid piece of wood or from fragmented pieces, fruit bowls are a sought-after item for the home and are therefore a profitable woodworking project.

Picture Frames

Wooden picture frames are easy to make and can be made to look unique by the decoration, color and embellishments you add to the wooden frame. Wooden picture frames will always be in demand and being inexpensive to make, are a profitable woodwork project to embark on.

Plant Boxes

Wood is a great material for robust and eye-catching plant boxes, which make a great addition to patios, terraces, gardens and even indoors. These simple-to-make and sought-after items are one of the most inexpensive and profitable woodburning projects you can get involved in.

Wooden Furniture

It’s hard to resist a piece of bespoke, handmade wooden furniture that provides a robust, lasting and practical feature in the home. From coffee tables made from pine to wardrobes in mahogany, set yourself a rewarding and profitable woodworking project making beautiful pieces of furniture.

Wooden Utensils

Spoons, knives, forks and other utensils made out of wood don’t just look great and can be used solely as ornamental pieces, but they can be functional features in the kitchen and dining room, conducting heat more efficiently than metal utensils.

Capitalize on the unique properties of wooden utensils by making your own exclusive and highly profitable knives, forks and spoons made from wood.

Corner Wall Shelves

Corner wall shelves that are made from chunky wooden pieces provide a unique feature in both traditional and contemporary homes.

These woodworking projects are fun to try and, other than the wood and glue, cost next to nothing, meaning you can sell your creative inventions for a tidy profit.

Birdhouses

Birdhouses look fantastic when they are made from a high-quality wood and they aren’t as difficult to make as you might have thought. Start knocking together redwood, cedar, pine or cypress and you’ll have a desirable product bird-enthusiasts will want to buy from you.

Wooden Pallet Christmas Trees

Wooden pallet Christmas trees are incredibly easy to make and can be sold for a tidy profit for those seeking a quirky alternative to a real Christmas tree. Simply build your tree by placing pieces of pallet wood on top of one another and add some pretty Christmas decorations for a creative woodwork project you can sell for a profit.

Coffee Cup Racks

Like coat hangers but on a smaller scale, coffee cup racks are easy items to make from wood and make superb Christmas and birthday presents for anyone who loves unusual and quirky items in their home.

These desirable kitchen items don’t take long to make and are inexpensive, making wooden coffee cup racks profitable woodworking projects.

Dog Beds

Dog beds can be expensive and for dog owners looking for an alternative to plastic beds, ones made from wood could prove attractive. These sturdy, comfortable and attractive beds for dogs aren’t difficult or expensive to construct, making them a profitable woodworking project to build and sell.

Rustic Headboards

Put your artistic woodworking skills to best use by working on beautiful, handmade, rustic headboards made from stunning wood. Such pieces of furniture make a great addition to a bedroom and will always be in demand, making them a lucrative woodwork project to embark on.

Wine Racks

Wine racks made from wood are not only sturdy, but they look great in the home. These desirable items are neither expensive nor difficult to build and can be sold for a nice profit for wine-lovers looking for an eye-catching and robust place to store their bottles.

Photo via Shutterstock

This article, "14 Most Profitable Products for Handmade Woodworking Businesses to Build and Sell" was first published on Small Business Trends

Sunday, 30 December 2018

How to Help Your Introverted Employees Survive Holiday Office Parties (INFOGRAPHIC)

For most businesses, Christmas and New Year’s means office parties, but for introverts, this time of year can be highly stressful.

A new infographic by Simply Be titled, “An Introvert’s Guide to Office Parties” has 18 tips to help introverts navigate office functions around this time of year.

The infographic looks to provide a set of tools introverts can use before, during, and after work functions to handle their anxiety and even enjoy themselves.

Office functions might seem trivial, but for business owners and managers they provide more than just a way to let loose and have a good time.

In addition to bringing everyone in the organization together, they allow owners and managers to see how their employees interact with each other while identifying potential candidates for certain positions.

Introverts who fail to attend these gatherings might be missing out on opportunities without knowing it, which is what Simply Be says in the report.

It goes on to say, “…If you’re not attending work gatherings, it’s likely that you’ll be left out of office friendships and conversations – not to mention being at the back of management’s mind when it comes to promotions and pay rises.”

Help your introverted employees by sharing the infographic below to help the feel more comfortable at this stressful time of year.

Tips on Office Parties for Introverts

Before the party, the infographic says to be honest about whether you’ll be attending or not. Saying you’ll attend and not showing up will make your work environment even more uncomfortable as an introvert.

Another tip is to make the decision on whether it is worth attending the party. If your presence is not required and it is too stressful, you should consider not attending.

Once you have made the decision to go, set a goal for the party to make it easier to socialize while you’re there. This includes practicing conversations, brushing up on current events and having some talking points ready.

The infographic says this might be a bit extreme, but for introverts going through this process will help overcome the anxieties of attending the party.

Two additional tips before introverted employees go to a party include resting or charging their batteries and finding someone they are comfortable with (wingman/woman) to attend the event with them.

When at the party, introverted employees can use existing friends to make new ones, and above all should avoid drinking too much because the outcome could be less than desirable. At the same time, introverted employees should have an exit plan just in case they are feeling particularly anxious or tired.

After the party, they can wind down by taking a bath, taking a walk, or spending some quiet time alone. Introverted employees can build on this experience by attending other parties outside of the workplace until they are wholly comfortable no matter where they are.

The key is to identify what makes them uncomfortable, finding solutions, and implementing said solutions at their own pace.

Introverts

The infographic lists five main traits of an introvert. Knowing these traits can also help owners and managers identify introverts who might be having a hard time fitting in with the organization even though they are great employees.

Once you identify these employees, you can work with them to slowly bring them into the fold with the rest of the organization so they can feel more comfortable in the workplace. At the same time, you can also make workplace functions optional for them until they are ready to attend.

You can see these five traits and the rest of the tips in the infographic below.

Photo via Shutterstock

This article, "How to Help Your Introverted Employees Survive Holiday Office Parties (INFOGRAPHIC)" was first published on Small Business Trends

Top 2018 YouTube Trends for Small Business

Since its launch back in 2005, YouTube has become the premier online destination for video content. For small businesses, YouTube provides a number of unique opportunities, from video marketing for a specific product or service to earning an income through the YouTube Partner Program.

2018 YouTube Trends

Here are some statistics and trends that could be of interest for entrepreneurs looking to leverage the power of YouTube.

YouTube Popularity

- YouTube has more than 1.9 billion logged-in users who visit YouTube every month.

- YouTube is adding 900,000 unique visitors every month.

- By 2019, YouTube is expected to increase its user base by 187.8 million.

- YouTube has also become one of the most popular online platforms for teens. 85 percent of teens say they use the platform.

- In addition, 32 percent of teens say they use YouTube more than any other platform, making it second only to Snapchat.

- 81 percent of parents with kids 11 and younger said they let their kids watch YouTube videos.

- And 34 percent of those parents say it’s a regular occurrence.

Popular Types of YouTube Videos

- Entertainment related videos get an average of 9,816 views per month.

- How-to and style videos receive an average of 8,332 views per month.

- Science and technology related videos receive an average of 6,638 views per month.

- Videos related to pets and animals receive an average of 6,542 views per month.

- Videos related to autos and vehicles receive an average of 5,673 views per month.

- Education related videos receive an average of 4,872 views per month.

- Videos related to travel and events receive an average of 3,070 views per month.

- Gaming related videos receive an average of 3,050 views per month.

- Videos related to people or vlogs receive an average of 2,354 views per month.

- 35 percent of adults turn to YouTube for how-tos or tutorials.

Ideal YouTube Videos

- 70 percent of YouTube users view videos on their mobile devices. So mobile friendly videos are incredibly important.

- Short videos tend to be especially popular on YouTube. Research has suggested that the ideal length is between one and two minutes.

- In fact, 56 percent of all videos posted online in the past year are two minutes long or less.

- The YouTube algorithm tends to favor those who post new videos consistently, as well as those who use consistent and relevant keywords.

- Optimal thumbnails for YouTube videos should be 1280px wide by 720px tall.

YouTube Marketing

- 700 YouTube videos are shared on Twitter every minute.

- 500 years worth of YouTube videos are watched every day on Facebook.

- And 100 million people like, comment or interact with at least one YouTube video each week.

- 19 percent of YouTube users consider YouTube videos to be very important when they’re making a decision about buying a particular product.

YouTube Ad Revenue

- YouTube monetizes at least 3 billion video views per week.

- The number of creators earning six figures per year on YouTube has increased by 40 percent year on year.

- The number of creators earning five figures per year on YouTube has increased by 50 percent year on year.

- About 250 brands pulled YouTube ads last year when they found that their ads were running alongside content they didn’t want to be associated with.

- YouTube also implemented some changes that require creators to have at least 1,000 subscribers and 4,000 watch hours within the last year.

Bottom Line

These statistics show just how powerful and effective YouTube can be for small businesses. Whether you’re looking to market a product or service or actually earn a living from the video content you post, there’s an audience for your brand on this popular platform. Here are some more articles and resources to check out as you shape your business’s YouTube strategy.

- 20 YouTube Video Ideas to Put on Your Small Business’s Channel.

- How to Market YouTube Videos More Effectively.

- 50 Small Businesses You Can Start on YouTube.

- 25 Top YouTube Channels for Small Business Owners and Entrepreneurs.

- YouTube’s New Design Overhaul Signals Changes for Small Business Owners Too.

Photo via Shutterstock

This article, "Top 2018 YouTube Trends for Small Business" was first published on Small Business Trends