Key to the success of small businesses across the country is finding the right suppliers. And the Business-to-Small-Business marketplace (B2SMB) is essential in finding the best suppliers.

The 2019 BEST2 SMB AWARDS will recognize the best brand to small businesses with the products, services and innovation the provide.

With a market value of $500 billion, the B2SMB supports 30+ million small business who buy products and services in the U.S.

The yearly award is organized by the B2SMB Institute, which looks to bring together the highly fragmented B2SMB marketplace.

The mission of the organization is to ensure the growth of B2SMB professionals so they can succeed by winning, keeping and growing small business customers.

The B2SMB Institute’s Influencers’ Circle will choose the winners. The influencers are an independent council of journalists, bloggers, thought leaders and authors.

Anita Campbell, CEO and Founder of Small Business Trends, is one of the judges who will be choosing the winners.

The awards luncheon will showcase the winners on October 3, 2019, at the B2SMB Institute’s Global Conference in Chicago.

The deadline for all submissions is 5 pm EDT, September 4, 2019.

You can enter for free, so click the red button to get the submission guide.

Featured Events, Contests and Awards

Best SMB Awards

Best SMB Awards

September 04, 2019, Online

Does your product or service stand-out in the crowded marketplace for Small Business? The B2SMB Institute invites any enterprise that markets, sells and delivers products and/or services to Small Businesses to submit their entry for the 2019 Best2SMB Awards. We’ll be awarding excellence and achievement in three categories: Best2SMB Product or Service Offering, Best2SMB Innovation, Best2SMB Brand of the Year. We will also be awarding our first-ever Best2SMB Hall of Fame recipient.

Free seminar: Learn how to optimize your business (San Francisco, CA)

Free seminar: Learn how to optimize your business (San Francisco, CA)

October 15, 2019, San Francisco, Calif.

Join us to learn how one complete view of your business, with apps that effortlessly integrate, can enhance your productivity, increase customer satisfaction, and help you effectively collaborate with staff, partners, and investors. Our free educational seminar will cover basics of the Zoho One platform, plus tips, tricks, and best practices to help optimize your business.

Listening to the Voice of the Customer

Listening to the Voice of the Customer

October 16, 2019, Chicago, Ill.

Led by veteran product development and market research experts, this course will introduce Voice of the Customer (VOC) market research and teach you to use it to accelerate innovation in business-to-business markets. The workshop uses a lively, interactive format with numerous hands-on activities and practice exercises to build skills and will also expose you to the latest applications of these techniques in areas such as machine learning and journey mapping.

Discount Code

SMALLBIZ ($100 Off)

Free seminar: Learn how to optimize your business (Irvine, CA)

Free seminar: Learn how to optimize your business (Irvine, CA)

October 17, 2019, Irvine, Calif.

Join us to learn how one complete view of your business, with apps that effortlessly integrate, can enhance your productivity, increase customer satisfaction, and help you effectively collaborate with staff, partners, and investors. Our free educational seminar will cover basics of the Zoho One platform, plus tips, tricks, and best practices to help optimize your business.

Free seminar: Learn how to optimize your business (San Diego, CA)

Free seminar: Learn how to optimize your business (San Diego, CA)

October 18, 2019, Online

Join us to learn how one complete view of your business, with apps that effortlessly integrate, can enhance your productivity, increase customer satisfaction, and help you effectively collaborate with staff, partners, and investors. Our free educational seminar will cover basics of the Zoho One platform, plus tips, tricks, and best practices to help optimize your business.

Free seminar: Learn how to optimize your business (Miami, FL)

Free seminar: Learn how to optimize your business (Miami, FL)

October 22, 2019, Miami, Fla.

Join us to learn how one complete view of your business, with apps that effortlessly integrate, can enhance your productivity, increase customer satisfaction, and help you effectively collaborate with staff, partners, and investors. Our free educational seminar will cover basics of the Zoho One platform, plus tips, tricks, and best practices to help optimize your business.

Free seminar: Learn how to optimize your business (Boston, MA)

Free seminar: Learn how to optimize your business (Boston, MA)

October 24, 2019, Online

Join us to learn how one complete view of your business, with apps that effortlessly integrate, can enhance your productivity, increase customer satisfaction, and help you effectively collaborate with staff, partners, and investors. Our free educational seminar will cover basics of the Zoho One platform, plus tips, tricks, and best practices to help optimize your business.

Free seminar: Learn how to optimize your business (New York, NY)

Free seminar: Learn how to optimize your business (New York, NY)

October 25, 2019, New York, N.Y.

Join us to learn how one complete view of your business, with apps that effortlessly integrate, can enhance your productivity, increase customer satisfaction, and help you effectively collaborate with staff, partners, and investors. Our free educational seminar will cover basics of the Zoho One platform, plus tips, tricks, and best practices to help optimize your business.

Free seminar: Learn how to optimize your business (Seattle, WA)

Free seminar: Learn how to optimize your business (Seattle, WA)

November 12, 2019, Online

Join us to learn how one complete view of your business, with apps that effortlessly integrate, can enhance your productivity, increase customer satisfaction, and help you effectively collaborate with staff, partners, and investors. Our free educational seminar will cover basics of the Zoho One platform, plus tips, tricks, and best practices to help optimize your business.

Free seminar: Learn how to optimize your business (Denver, CO)

Free seminar: Learn how to optimize your business (Denver, CO)

November 14, 2019, Denver, Colo.

Join us to learn how one complete view of your business, with apps that effortlessly integrate, can enhance your productivity, increase customer satisfaction, and help you effectively collaborate with staff, partners, and investors. Our free educational seminar will cover basics of the Zoho One platform, plus tips, tricks, and best practices to help optimize your business.

Free seminar: Learn how to optimize your business (Chicago, IL)

Free seminar: Learn how to optimize your business (Chicago, IL)

November 15, 2019, Chicago, Ill.

Join us to learn how one complete view of your business, with apps that effortlessly integrate, can enhance your productivity, increase customer satisfaction, and help you effectively collaborate with staff, partners, and investors. Our free educational seminar will cover basics of the Zoho One platform, plus tips, tricks, and best practices to help optimize your business.

Free seminar: Learn how to optimize your business (Atlanta, GA)

Free seminar: Learn how to optimize your business (Atlanta, GA)

November 19, 2019, Atlanta, Ga.

Join us to learn how one complete view of your business, with apps that effortlessly integrate, can enhance your productivity, increase customer satisfaction, and help you effectively collaborate with staff, partners, and investors. Our free educational seminar will cover basics of the Zoho One platform, plus tips, tricks, and best practices to help optimize your business.

Small Biz: Banking Conference

Small Biz: Banking Conference

November 19, 2019, Los Angeles, Calif.

The small biz: banking conference delivers access to thought leadership, best practices and leading solution providers. Discover how industry leaders attract and retain small business deposits, fee-based services, and loans, and much more.

Discount Code

BIZTRENDS ($200)

Free seminar: Learn how to optimize your business (Dallas, TX)

Free seminar: Learn how to optimize your business (Dallas, TX)

November 21, 2019, Dallas, Texas

Join us to learn how one complete view of your business, with apps that effortlessly integrate, can enhance your productivity, increase customer satisfaction, and help you effectively collaborate with staff, partners, and investors. Our free educational seminar will cover basics of the Zoho One platform, plus tips, tricks, and best practices to help optimize your business.

Free seminar: Learn how to optimize your business (Phoenix, AZ)

Free seminar: Learn how to optimize your business (Phoenix, AZ)

November 22, 2019, Phoenix, Ariz.

Join us to learn how one complete view of your business, with apps that effortlessly integrate, can enhance your productivity, increase customer satisfaction, and help you effectively collaborate with staff, partners, and investors. Our free educational seminar will cover basics of the Zoho One platform, plus tips, tricks, and best practices to help optimize your business.

More Events

- DigiMarCon Europe 2019 – Digital Marketing Conference & Exhibition

September 12, 2019, Amsterdam, Netherlands - Launching a Business – Application Deadline

September 13, 2019, Oakland, Calif. - DigiMarCon Asia Pacific 2019 – Digital Marketing Conference & Exhibition

September 18, 2019, Singapore - World’s Largest MBA Tour is Coming to Philadelphia – Register for FREE

September 30, 2019, Philadelphia, Pa. - DigiMarCon Singapore 2019 – Digital Marketing Conference & Exhibition

October 02, 2019, Singapore, Singapore - World’s Largest MBA Tour is Coming to Miami – Register for FREE

October 16, 2019, Miami, Fla. - World’s Largest MBA Tour is Coming to Austin – Register for FREE

October 21, 2019, Austin, Texas - TECHSPO Dubai 2019

October 22, 2019, Dubai, United Arab Emirates - Rhodium Weekend

October 24, 2019, Las Vegas, Nev. - World’s Largest MBA Tour is Coming to Denver – Register for FREE

October 28, 2019, Denver, Colo. - Small Business Expo 2019 – LOS ANGELES (October 30, 2019)

October 30, 2019, Los Angeles, Calif. - IMPACT>MOBILITY USA 2019

November 04, 2019, San Diego, Calif. - HR World 2019

November 14, 2019, Nashville, Tenn. - 4th Annual Blockchain Opportunity Summit 2019

December 10, 2019, New York, N.Y. - Pitch Deck Summit

December 11, 2019, Austin, Texas - National Small Business Week

May 03, 2020, Online

More Contests

This weekly listing of small business events, contests and awards is provided as a community service by Small Business Trends.

You can see a full list of events, contest and award listings or post your own events by visiting the Small Business Events Calendar.

Image: Depositphotos.com

This article, "Get Attention for Your Business-to-SMB Product or Service, Read More" was first published on Small Business Trends

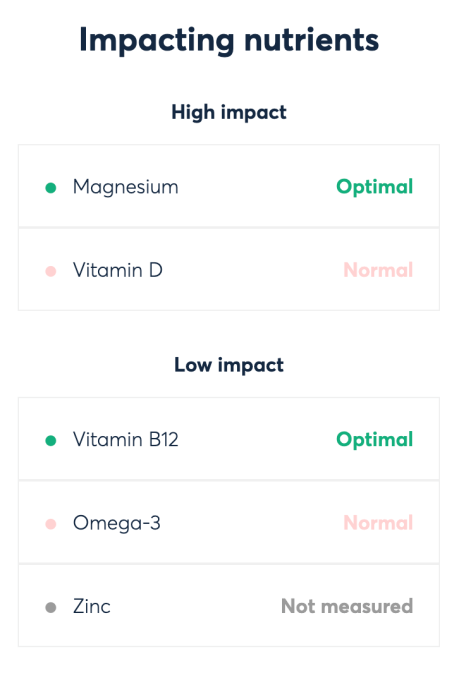

I had the opportunity to try out the test myself. It’s pretty simple to do. You just open up a little pear-shaped device, pop it on your arm and then press it to engage and get it to start collecting your blood. After it’s done, plop it in the provided medical packaging and ship it off to a Baze contracted lab.

I had the opportunity to try out the test myself. It’s pretty simple to do. You just open up a little pear-shaped device, pop it on your arm and then press it to engage and get it to start collecting your blood. After it’s done, plop it in the provided medical packaging and ship it off to a Baze contracted lab.

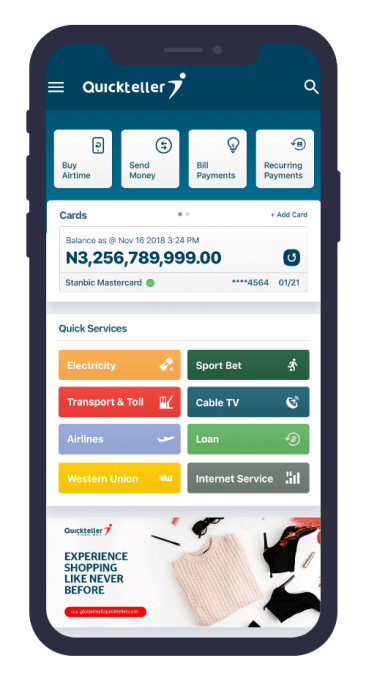

Another facet to a possible Interswitch IPO is its potential to spark more corporate venture arm and acquisition activity in African fintech, which as a sector receives the bulk of the continent’s startup capital. Interswitch launched a venture arm in 2015

Another facet to a possible Interswitch IPO is its potential to spark more corporate venture arm and acquisition activity in African fintech, which as a sector receives the bulk of the continent’s startup capital. Interswitch launched a venture arm in 2015