For most people in India, having to engage with banks doesn’t instill a sense of joy. Banks in the South Asian market are notorious for making unannounced spam calls to upsell customers loans and credit cards, even when they have been explicitly asked not to do so.

Moreover, when a customer does reach out to a bank with a query, it can take forever to get the job done. Take ICICI Bank, India’s third largest bank and until recently my only banking partner for over six years, for an example.

It is now in its third month in figuring out who exactly in its relationship with Amazon is supposed to re-issue me a credit card. I have moved on with my life, and it looks like they did, too, likely before they even looked at my query.

Small and medium-sized businesses aren’t a big fan of banks, either. If you operate an early-stage startup, it’s anyone’s guess if you will ever be able to convince a bank to issue you a corporate account. So of course, startups — Razorpay and Open — took it upon themselves to fix this experience.

For consumers, too, in recent years, scores of startups have arrived on the scene to improve this banking experience. Whether you are a teenager, or just out of college, or a working professional, or don’t have a credit score, there are firms that can get you a credit card and loan.

But even these services have a ceiling limit of some sort. And customers aren’t loyal to any startup.

“A customer’s relationship is always with the entity where they park their savings deposit,” said Jitendra Gupta, a high-profile entrepreneur who has spent a decade in the fintech world. Since these customers are not parking their money with fintech, “the startups have been unable to disrupt the bank. That’s the hard reality.”

So what’s the alternative? Gupta, who co-founded CitrusPay (sold to Naspers’ PayU) and served as managing director of PayU, has been thinking about these challenges for more than two years.

“If you really want to change the banking industry, you cannot operate from the side. You have to fight from the centre, where they deposit their money. It’s a very time-consuming process and requires a lot of initial capital and experience with banks,” he told TechCrunch in an interview.

After more than a year and a half of raising about $24 million — from Sequoia Capital India, 3one4 Capital, Amrish Rau, Kunal Shah, Kunal Bahl, Tanglin Venture Partners, Rainmatter and others — Gupta is ready to launch what he believes will address a lot of the issues individuals face with their banks.

His new startup, called Jupiter, wants to bring “delight” to the banking experience, and it will launch in India on Thursday.

“We believe that a bank account should be a smart account, where it gives you insight, shares personalized tips and guides you through attaining some financial discipline,” he said.

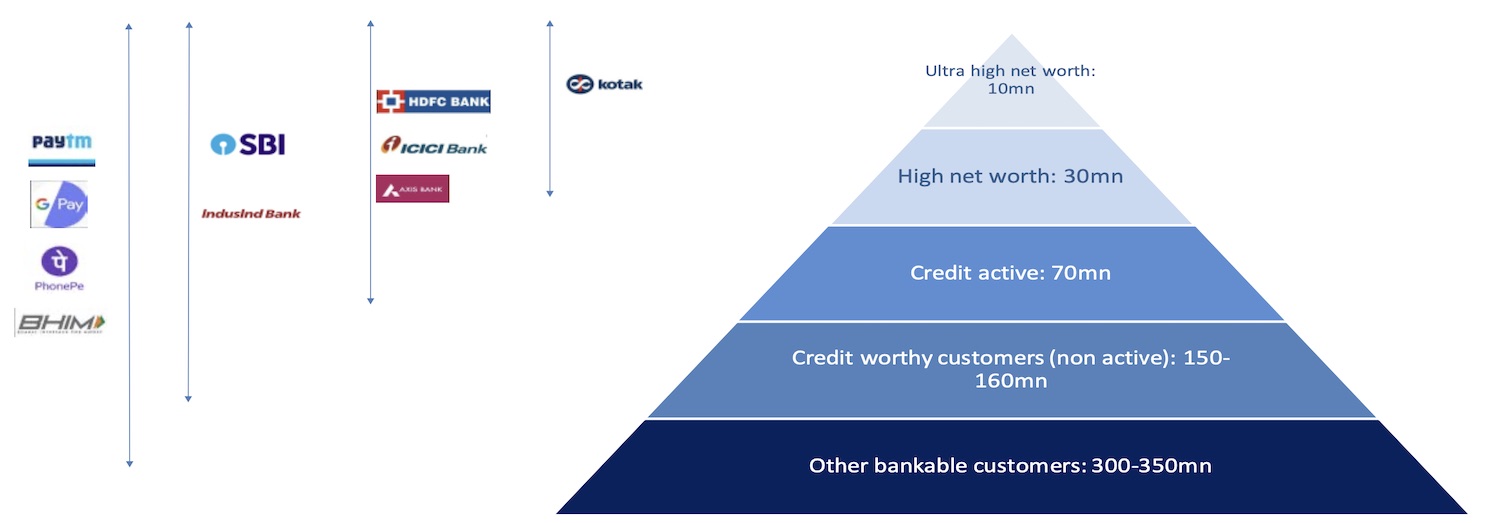

A snapshot of the reach of banks and fintech startups in India. Data: CIBIL, Statista, BofA Global Research. Image: BofA

To be sure, Jupiter, too, will offer loans and other financial services to customers. But instead of making irrelevant calls to customers, it will assess which of its customers are running short on money and give the option to take a credit line from its app itself, he said. “The upsell doesn’t need to happen by way of spam. It needs to happen by way of contextualization and personalization.”

“Jupiter has been built in a deep integration with the underlying bank, allowing the consumer to have a frictionless experience for all their banking needs,” said Amrish Rau, chief executive of Pine Labs, co-founder of CitrusPay and longtime friend of Gupta.

The startup, which employs 115 people, has developed a number of products for customers joining on day one. The products include the ability to buy now and pay later on UPI, a feature first offered in the market by Jupiter, and a mutual fund portfolio analyzer. A debit card, in-app chat with a customer service agent, expense categorisation, finding the right card, determining the existing health insurance coverage, and more are ready to ship, the startup said.

Jupiter is currently working on providing zero mark-up on forex transactions, and frictionless two-factor authentication. The startup has published a public Trello page where it has outlined the features it is working on and when it expects to ship them, as well as features suggested by its beta-testing customers. “I want to establish full transparency in what we are working on to build trust with customers,” said Gupta.

Jupiter will have its own customer relationship team that will engage with the startup’s users. The startup, which last month opened a waiting list for customers to sign up, had amassed more than 25,000 applications as of two weeks ago.

Even Jupiter, which one day wishes to disrupt the banking sector, currently has to partner with banks. Its partners are Federal Bank and Axis Bank.

I asked Gupta about the excitement his investors see in Jupiter. “Everyone believes, as you see with fintech giants such as Nubank globally, that we will become a full bank,” he said.

But for the time being, Gupta said he is not looking to partner with more banks. “I don’t want Jupiter to attract customers because they want to bank with Federal or Axis. I want them to come to Jupiter because they want to bank with Jupiter,” he said.

In the next 12 months, the startup hopes to serve more than 1 million customers.

No comments:

Post a Comment